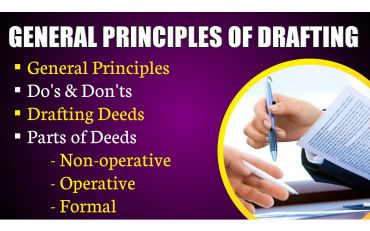

We don’t draft, we craft

To optimize the operational efficiency, increase flexibility, and reduce costs by outsourcing day to day tasks your business can handle this in a very well informed narrative. Our team of Legal professionals will handle this agreements and contracts in a very efficient way so that you can choose to “seize your moment” Carpe Diem.